Maybe this is obvious. Maybe not.

A common crypto message is about disintermediation because trust is built into the network. Oh, and a distributed ledger. So, people complain "why wouldn't I juse use a database? Databases are faster, right?"

Well, yeah. But whose database?

The thing about crypto is that it's not anyone's database. Or, rather, it's the network's. And as such you don't need an intermediary to oversee what's in the database.

What is a stock market anyways? It's a market. A place where people come to buy/sell securities. Since it's hard for two parties to trust each other, the NYSE enforces rules and acts as an intermediary between market participants.

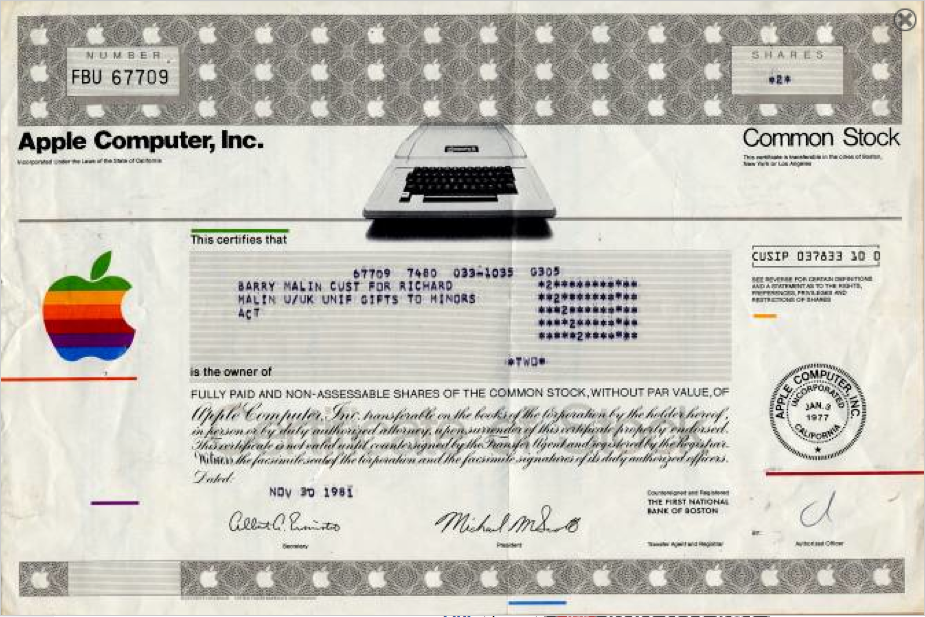

Today, an IPO involves issuing shares in the form of stock certificates that are really database entries. Read "After the Trade is Made" if you want to know how this all works.

Fundamentally, there's no difference between a stock certificate and an NFT of a stock certificate. Or, between a stock certificate and an NFT.

Stock ownership confers rights.

NFT ownership confers rights.

NYSE has rules about the lifecycle of those rights.

Smart Contracts can create rules about the lifecycle of those rights.

One important difference?

If I own an NFT, I don't need some organization like NYSE to validate me.

I can simply point people onchain where they can see my ownership, and the exact provenance of my ownership. Or, I can login with the wallet containing the NFT to exercise my rights like voting at an annual meeting.

It's useful to understand that an NFT is "just" a token pointing at an object. The token is the same token when people talk about "coins" and crypto.

For example: I have a few ENS domains, and as such, I got airdropped ENS tokens (as an early adopter). Those ENS tokens allow me to vote on things that affect the ENS DAO. There's no NFT associated with those tokens (though, my ENS domain is an NFT as far as I understand things, but there's no connection between my domains and my ENS tokens). So, voting with an NFT isn't really that unusual (though it is still quite uncommon). You can read more about how ENS tokens are used in governance of the public good that is ENS to get an idea for how stock ownership could be replicated by NFTs.

So, I'm not surprised NYSE is exploring the space. They're smart. I'd be surprised if they weren't.

That said, they need to consider emerging technology from BCware that abstracts away the details of the specific chains and smart contracts and makes NFTs portable across chains and wallets, simplifying their issuance, while adding the ability to bring together on- and off-chain information to enrich the NFT offerings.

This is an exciting time.

By the way, if you'd like to keep up on the NFT news and happenings that are influencing my thinking, keep an eye on this "all about the NFT industry" page I'm using to capture it all so I don't lose track of what I'm learning.