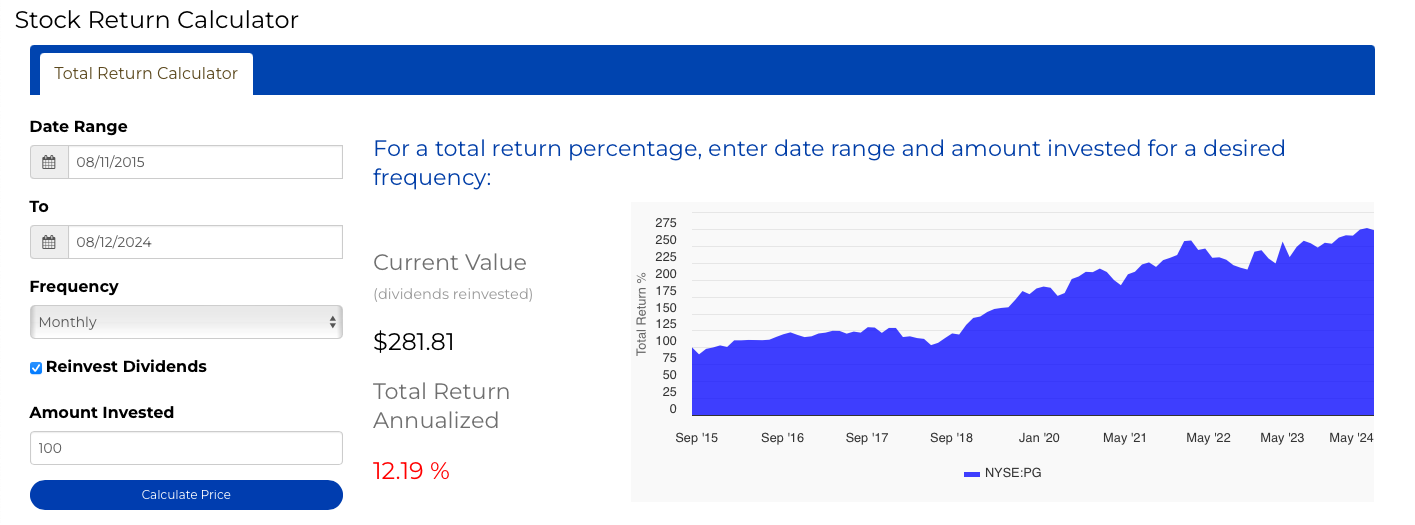

I was working on updating my dividend investment selection worksheet and came across this cool dividend reinvestment growth calculator on Proctor & Gamble's investor relations website that I just have to share.

This example really highlights the additional return gained by reinvesting dividends.

P&G as an example

This site of course only works for P&G, but it shows what your return would be had you invested small amounts in P&G regularly. Of more interest to me (us), is that it has a checkbox for reinvesting dividends, making clear the difference in returns when you reinvest your dividends.

Head over to P&G and follow along...

- Scroll down to the Stock Return Calculator

- Pick a date range, easy enough to pick the past year as a starting point

- I'd select a frequency of monthly; this frequency is how often you'd invest... and then the following field asks for the amount you'd invest monthly.

- Hit calculate price (I'm not sure they really mean calculate price, but rather calculate return!)

Without reinvesting dividends

I put in 8/11/23 - 8/12/24, with a monthly investment of $100.

Without reinvesting dividends, my total annualized return is 6.2%. Not bad.

With the magic of reinvesting dividends

But watch what happens when we hit the reinvest dividends checkbox (and recalculate "price")...

That jumps to an annualized return of 8.88%.

That's an extra 2.68% return having reinvested dividends over a single year. That's a big enough difference to, well, make a difference.

Looking even further back

I'm not sure how P&G has done relative to the market in the past year and all that. But I did a quick calculation to see what would have happened if I had invested $100/month for the past 10 years and reinvested dividends - my total annualized return would have been over 12%. That's really admirable.

Using the rule of 72, it would have taken just 6 years (on average) to double your investment at that annualized rate of return.