Sometimes we use words as shortcuts. The title is one such case. Bitcoin is threatening, but DeFi is the real threat. I used 'bitcoin' to keep it simple and because readers would understand the use of bitcoin in this context.

Here’s some interesting news just from this week that makes this relevant.

A company that’s been doing crypto well: Fidelity

Fidelity’s head of digital assets says that bitcoin adoption will continue “at an accelerated pace,” noting that “we’ve reached a tipping point.” He explained that investors are increasingly drawn to bitcoin “Particularly, in an environment where we’ve seen unprecedented monetary and fiscal stimulus from central banks and governments in response to the pandemic.”

Fidelity’s Tom Jessop makes some very clear points that are fundamental to the current bitcoin bull run. What’s interesting is that Tom referred to bitcoin as an investment class, when just a year ago the banks didn’t consider it such.

There’s an interesting observation, interesting but not so obvious. Let’s say you have a trillion dollars to invest. Can you invest in an asset worth just $100B? Not unless you want to own it, and even then, what do you do with the other $900B? Crypto, even now, is still quite a small asset class... but it is get bigger all the time. As it gets bigger, people who simply couldn’t consider it in the past, now can.

That and the money printing / inflation are pretty important (according to the stuff I’m paying attention to... I’m not the expert here).

Fidelity stands in contrast to those not handling it so well.

HSBC doesn’t get it

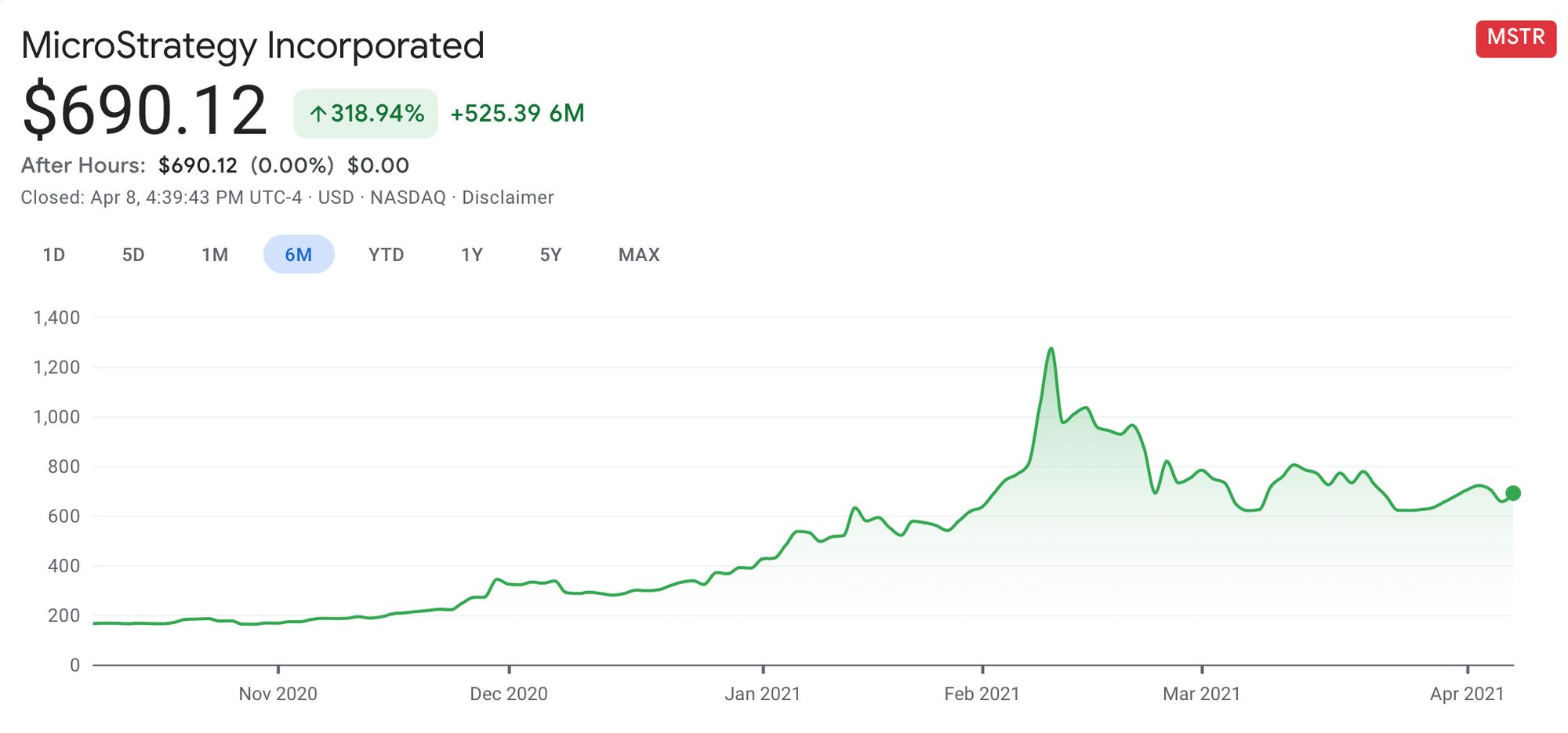

If you’ve been paying any attention at all you’ve noticed that MicroStrategy has been accumulating bitcoin in their corporate treasury. In fact, MicroStrategy was a good way to get bitcoin exposure if (for regulatory reasons) you couldn’t otherwise get bitcoin exposure.

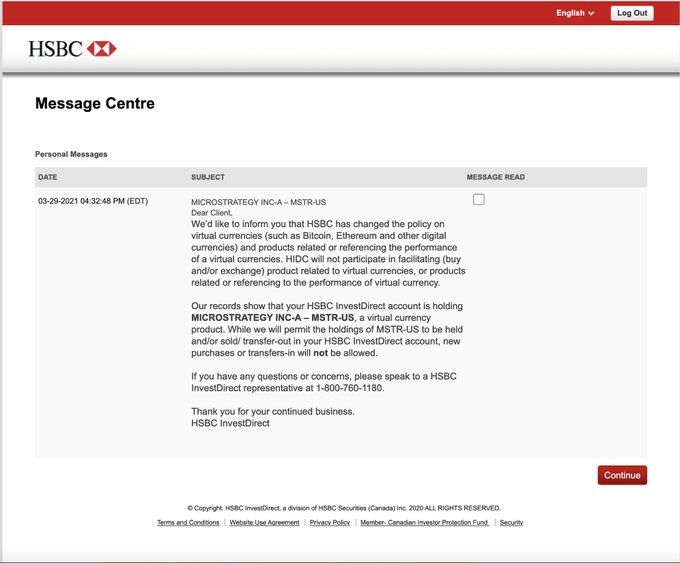

So, HSBC sends out this note:

This is exactly what the DeFi bulls went apeshit over with the whole GameStop/Robinhood thing. This is the power and challenge of DeFi... no one can shut you off from the opportunity, and that amount of responsibility is a heavy burden to bear.

HSBC won’t let customers buy shares of companies who own Bitcoin. What a ridiculous policy. https://t.co/iQfOZQaAnQ

— Mike Rundle (@flyosity) April 9, 2021

HSBC is on the wrong side of history here.

The new kids on the block

Here’s a comparison between Coinbase’s recently released numbers and regular FinTech (though, they compare to online brokers, which I don’t really think of as FinTech).

Coinbase is going public. It’s highly anticipated. Here’s a good primer on the numbers they released earlier in the week.

Expect more companies like Coinbase. These companies are bridges to DeFi, helping people gain crypto experience. Some people will move from there to “real” DeFi. For others, exposure to crypto through trusted companies like Coinbase is enough.

These companies are going to take the best customers from the old banks, deliver the innovation that the market wants, and growth and relevance of much of the old guard will fade away.