Market Cap vs Token Cap

Following the crypto space, I often see a conflation between market capitalization and token capitalization.

Market Cap is simple to understand. It's the number of shares outstanding multiplied by the share price. It's the value of the company, in theory based on financial fundamentals. Meaning, it's based on revenue, profit, expectations of the future, etc. Said differently, it's a value of the company based on how well the company is doing.

Coinbase for example, is a public company just like Apple. Or, more appropriately, like JP Morgan Chase. They're a crypto bank. There's nothing "crypto" about Coinbase the company, except for their product roadmap.

Coinbase does not have a token.

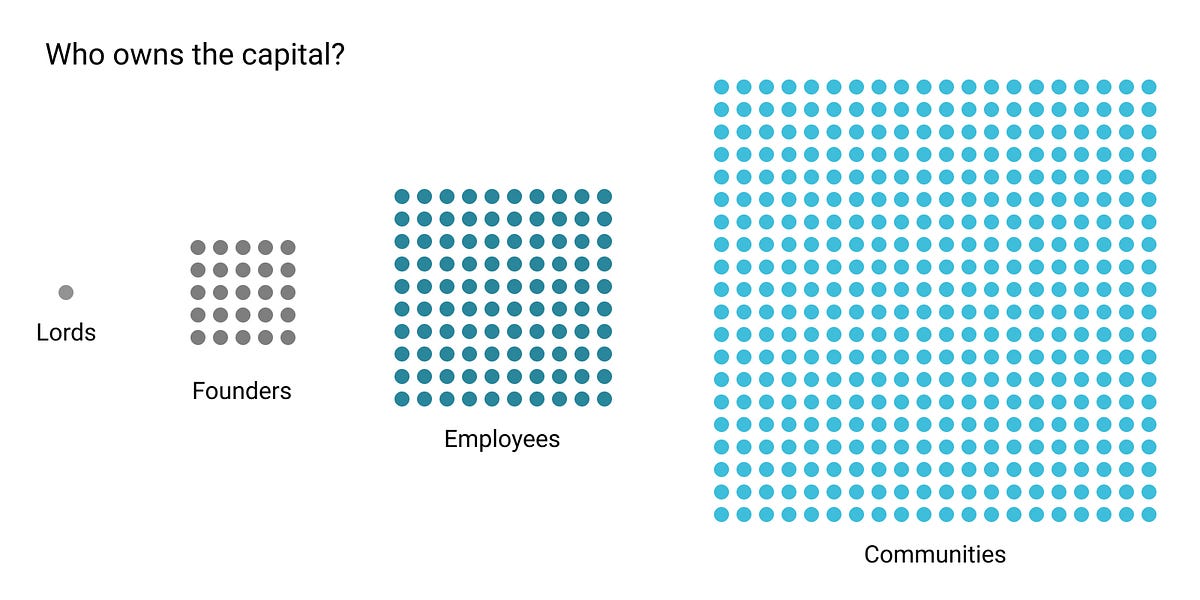

So what does the token measure? What's the "token cap" measure meant to value?

The crypto space uses Tokens as a measure of how well the community is doing.

I see many conversations on twitter where someone talks about how well a company is doing... then makes the jump to the conclusion that the token is going to do really well (or undervalued, or overvalued, etc). I find these conversations tiring.

Real-world examples of company value vs community value

I've used the example in the past of Microsoft to try to get people to see my point of view. Microsoft's share value represents Microsoft the company. Basically it's an investment in Microsoft.

Microsoft as a company has created a TON of value for others. Others capture that in their own market cap, if they're public. But Microsoft doesn't get any "financial credit" for that value created (except what they can extract through pricing, and in the case of enterprise software, maintenance).

But because Microsoft is a bit old-school and many don't realize how much value they've created for others, it's a hard point for me to make.

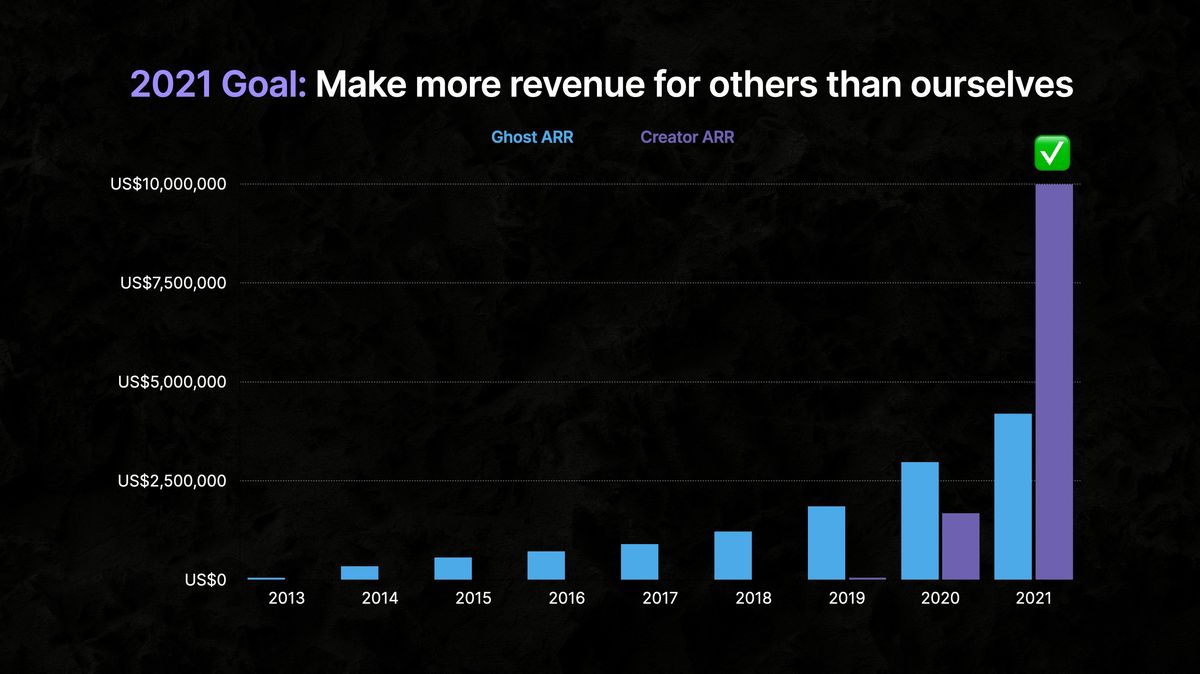

Today, I saw a tweet by someone I admire – John O'Nolan, the founder of Ghost (the product that runs this site using their GhostPro hosted offering). The tweet indicates exactly the underlying analytics used to differentiate between Market Cap and, if Ghost had a token with the right structure and tokenomics, it's Token Cap.

This time last year — we set a goal to have revenue generated by @Ghost for others, exceed our own. Now, 12 months later, we've hit that goal and gone even further. 📈

— John O'Nolan 🏴☠️ (@JohnONolan) January 7, 2022

Today, Ghost revenue:

$4,200,000 ARR

Creator revenue, generated *using* Ghost:

$10,200,000 ARR

2022 LFG 🤘 pic.twitter.com/NAIW2Kjsmg

One of the reasons I admire John and what he's doing with Ghost is because of their 2021 goal of making more revenue for others than for themselves.

The token is a measure of community utility, and the token cap would measure Ghost's impact on the community of writers that John and his team support.

Celsius, a real-world example

I often see this conversation around Celsius, one of my favorite companies in the crypto space. Their token ($CEL) had a bad 2021, even though the company was doing well by all traditional metrics (user growth, products launched, and assets under management).

Celsius has also raised traditional funding. The traditional metrics would apply to the value of the company's shares. The token price is a measure of value that the token delivers to the community.

I find it interesting to watch this play out, because maybe they'll be one of the first to have both a share and a token, and we can watch the market decide how each is valued based on Celsius' success (yes, I think their success is already determined).

A CEO's perspective on community value

If you'd like to get your head around a perspective on management that supports a token model vs an equity model, you absolutely must follow Ric Burton. Here are two recent posts of his on the importance of developing community to create successful companies (he might even take offense at the word company, preferring the word community; which of course, is exactly the point):

In closing

I hope to write more. Last year, I took care of my health and my family, and there wasn't much time to write.

If anything I wrote here got you thinking, just hit reply and drop me a note. I'd love to chat about these, or other ideas.

And if you want to support my writing, simply share it.

Of course, if you want to learn more about investing check out my book on Amazon (paperback or digital; if you purchase the paperback just ping me and I'll send you the digital version too), Apple Books, or Gumroad. You can buy it in the bookstore too, but it's too expensive there!