The Internet of Money

When the internet first emerged as a force for commerce, people got it. Crypto has been flying under the crazy banner for a decade, so it’s out in the open but people are (mostly) not paying attention. Crypto is bigger than most realize. Here’s a human explanation of why.

Originally in my latest email, I liked this section so much that I wanted to break it out separately.

It's really important to understand what's happening right now with money. It's not about cyrpto, it's not about anarchy, or money laundering, or energy use.

It's the underpining of a whole new financial and economic system that our kids will inherit. You can't underestimate how big an impact this will have on the way our kids work, earn, and play.

History Matters

It's about the decoupling of money from the state. These sorts of big things don't happen that often and are more in line with major historical events - like how the Church lost its monopoly on the written word when the printing press was invented.

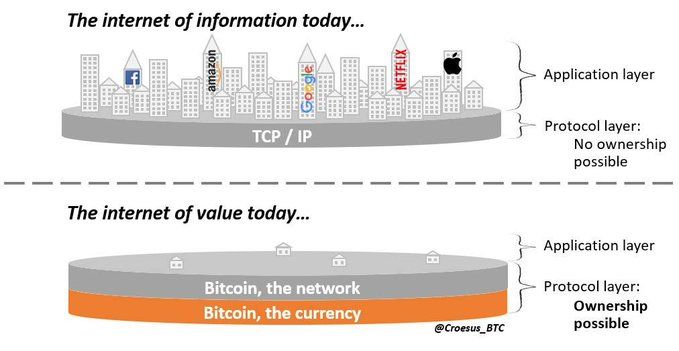

A more recent comparison is useful too. In the past, you'd invest in a company not a market. Now, you can invest in a protocol or a platform. It's like being able to invest in the internet as a collective, rather than having to try to pick the winners (who are obvious in retrospect only). Shahar says this wisely in a thread discussing the difference and scope of impact across various stages of the web:

The other critical difference between Web 2 and Web 3?

— Shahar (@ShaharAbrams) May 5, 2021

Web 3 is tokenized - it allows US to invest directly into the native infrastructure (Ethereum/ADA/DOT) as well as the application layer (dapp projects, Cefi/Defi, NFTs, etc)... VERY early on.

Don't sit this one out! 🙏😉

Shahar has his own crypto newsletter 'The Road to Babylon' for people interested in crypto but not that technical.

In Comparison to the Late 90's

Crypto is to money what the internet was to communications. Maybe that's why young investors in the UK prefer cryptocurrencies to stocks, or why PayPal is seeing such HUGE retail demand – in their words: multiple-fold on initial expectations – for their new cryptocurrency services. Read this interview with the Paypal CEO for more on his perspective.

Which makes for the obvious comparison. If someone had offered to sell you a piece of the internet in 1994 (knowing what you know now) you'd have sold a kidney. And, if models are your thing you need to read about the Stock-to-Flow model for bitcoin.

Bitcoin, but Also Ethereum

Of course, it's not just Bitcoin. People are starting to understand the importance of Ethereum and the explosive growth we might expect in the price of Ethereum in the coming 12 months. Even Mark Cuban gets it (and articulates it super clearly in this twitter thread).

Eth Smart Contracts for De-Fi are better at enabling depositing/saving/trading of financial instruments than banks. One is automated and trustless and near immediate. The other is dependent on buildings full of people who add cost and friction to the same transactions

— Mark Cuban (@mcuban) May 2, 2021

Read this post from 2019 that goes into how Ethereum derives its value. It's worth reading, even though it's old. It will help you understand the trajectory ETH has taken rather than this specific moment in time right now. It feels very positive, and it is, but I believe it's even more positive than most realize.

Ethereum is the foundation for the economic rails of the future. Everything will be built on top of it.

An Explosion of Innovation

On top of Ethereum will sit all sorts of innovations, innovations that will only come about over time as this new financial infrastructure becomes easier to use and more accessible. Read this NY Times article on crypto going mainstream to read about quite a few different use cases that 20-somethings are exploring. I don't know much about NFTs, but everyone from out-of-work college students, to authors, to Mark Cuban are experimenting. Personally, I think tokenized stock offerings will be a thing because they make compliant securitization simpler to govern. The fun part is that we don't yet know what will be successful.

How to Start

What are you waiting for?

Easily start using Coinbase, there's no excuse. And in case you want to go down the rabbit hole, here is a list of five free fintech and crypto newsletters from Forbes (I haven't taken a close look at this list yet myself, so let me know what you think if you try them).

One Last Thing

In response to an inbound question I wrote this about some of the dangers of crypto investing that I hope will help people keep their funds safe.